Most Medicare Advantage (MA) enrollees use one or more supplemental benefits, with most health plan members using multiple benefits, according to a newly released report from the Elevance Health Public Policy Institute.

The report finds that 83% of dual-eligible and 75% of non-dual-eligible individuals used at least one supplemental benefit a year. Those figures only drop to 64% and 48%, respectively, for using at least two different supplemental benefits. It also concluded that dual-eligible enrollees were more likely to live in a food desert, so they are more likely to self-select plans with strong supplemental benefit offerings.

“Further, dual eligible utilizers have a higher average CMS-HCC risk score than non-utilizers, suggesting they could be using their supplemental benefits to help address more intensive healthcare needs,” the report said.

The analysis concludes that MA enrollees see value in plans with supplemental benefits to address personalized needs. Many enrollees use grocery cards that allow for more spending on nutritious food, particularly for people living in food deserts with limited access to quality food.

Other members sign up for transportation benefits that allow people to complete errands like shopping for groceries or going to the bank. Both dual-eligible and non-dual-eligible utilizers of transportation benefits were found to have higher risk scores—and likely greater healthcare needs.

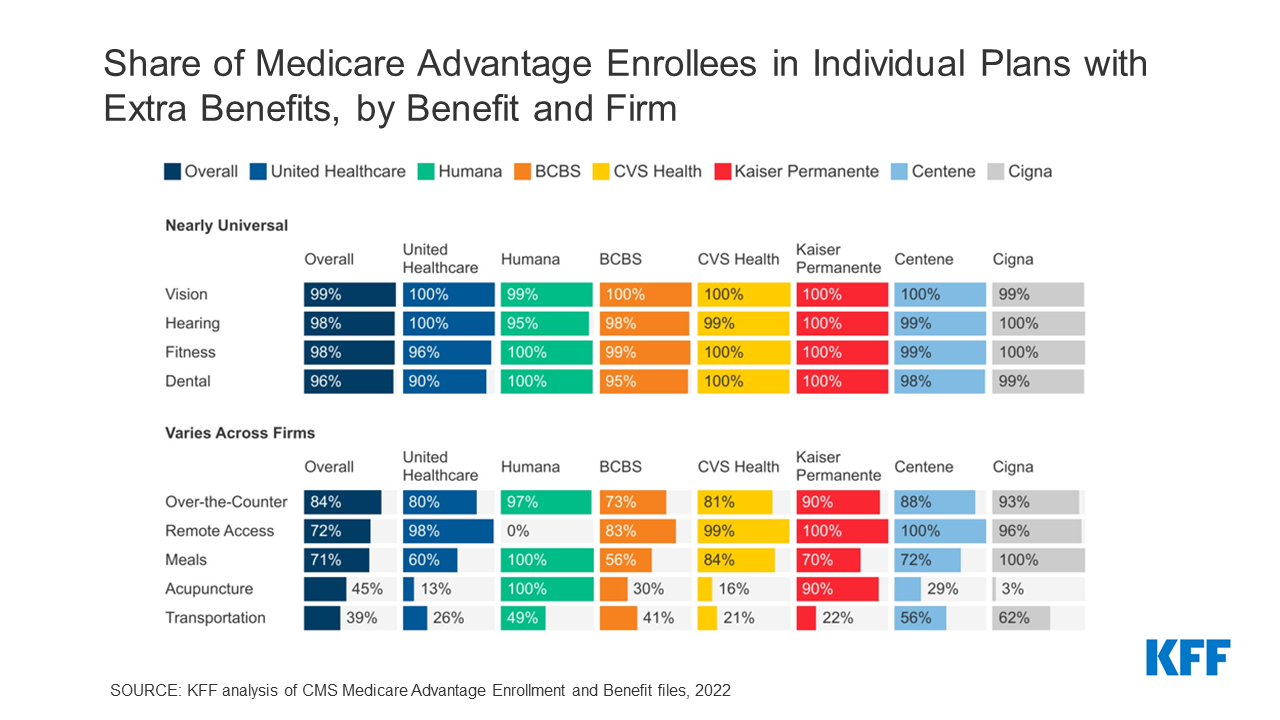

In 2019, CMS permitted supplemental benefits beyond vision and dental to include certain nonmedical services and different cost-sharing or tailored benefits.

Private MA plans can offer supplemental benefits due to the plan’s lower costs when compared to traditional Medicare, therefore enrollees can pick a plan that best suits their other individual needs. Congress has used MA to address food insecurity, as an enrollee could select a plan that offers meal benefits.

More than half of MA beneficiaries have annual incomes less than $25,000, and more than one-third identify as racial or ethnic minorities, the report says.

MA enrollment skyrocketed by 337% from 2006 to 2022, leaving the program on a path to insolvency, experts warn. Approximately half of all Medicare beneficiaries are enrolled in MA plans.