A key Senate committee on Wednesday advanced bipartisan legislation aimed at regulating pharmacy benefit managers, the intermediaries in the prescription drug supply chain who negotiate discounts with drug companies on behalf of insurance plans.

The Senate Finance Committee approved the measure by a vote of 25-1, showing the broad bipartisan interest in PBM reform. Only Sen. Ron Johnson (R-Wis.) voted no, arguing the bill would add more layers of government interference.

While other committees have also passed PBM reform bills, the Finance Committee has jurisdiction over Medicare and Medicaid, which make up a large portion of U.S. health spending. Still, all the separate bills in the House and Senate will need to be combined into one floor-friendly package.

Committee Chairman Ron Wyden (D-Ore.) said he has been talking with Majority Leader Charles Schumer (D-N.Y.) about the bill, but did not give any more details.

Among other provisions, the legislation would delink PBM compensation from the price of the drug, which would remove an incentive for PBMs to favor higher priced drugs.

The legislation would also ban spread pricing, which is when a PBM charges Medicaid more for prescription drugs than they pay.

Wyden and ranking member Sen. Mike Crapo (R-Idaho) noted that additional proposals on PBMs that didn’t make it into the bill on Wednesday could be added over the August recess.

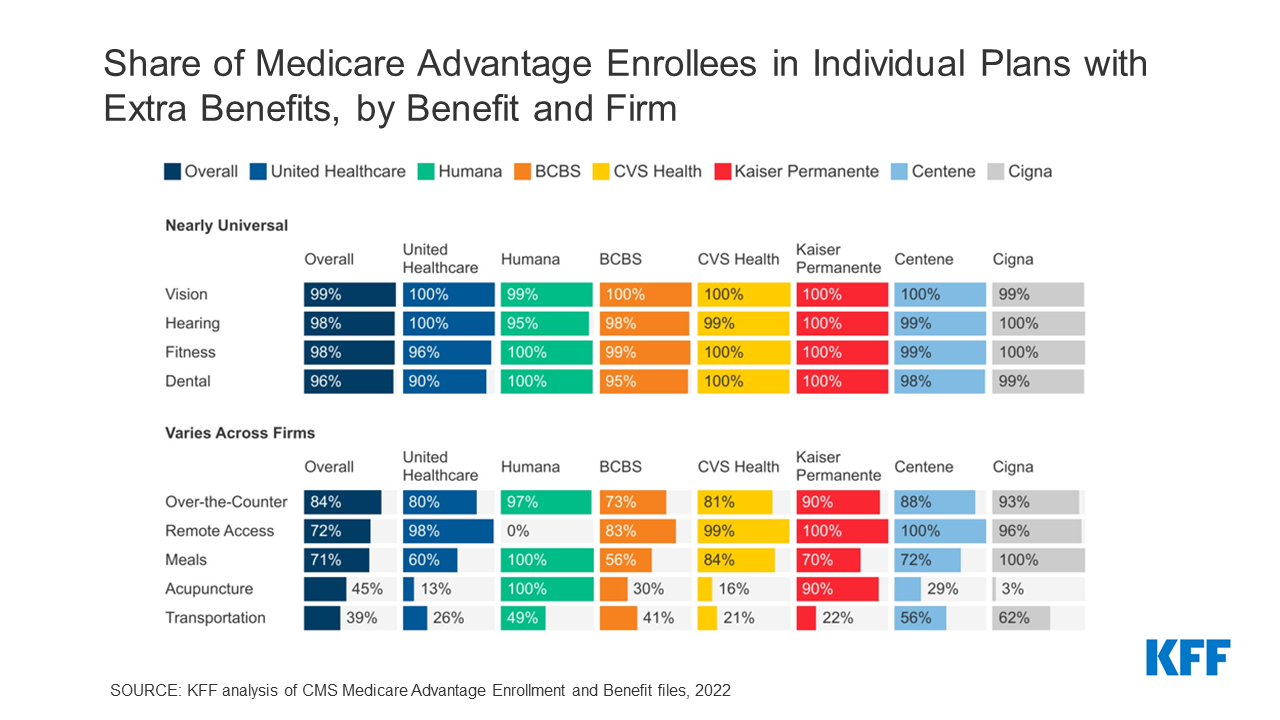

PBMs decide which drugs will be on a covered list of drugs, called a “formulary,” and how much a patient will have to pay for them. Three PBMs dominate the U.S. market: CVS Health’s Caremark, UnitedHealth’s OptumRx and Cigna’s Express Scripts.

The U.S. spends more than $4 trillion annually on health care, and Wyden said too much of that is being “frittered away on outdated middlemen practices.”

“The incentives of PBMs are just wrong. They win when prices are higher, not lower. Today’s proposals will flip that on its head,” Wyden said.

Drugmakers blame PBMs for the high costs of prescription drugs, though the PBM industry says their role is misunderstood and executives point fingers at the manufacturers.

PBMs collect rebates from drug manufacturers in exchange for coverage by a health plan.

The PBMs argue they can negotiate with insurers and manufacturers for lower drug costs and larger discounts for medications. They pass savings on to insurance plans, resulting in lower premiums for consumers.

Lawmakers have long been critical of PBMs, though the industry is not solely responsible for the high drug prices.

Sen. Sheldon Whitehouse (D-R.I) cautioned that members shouldn’t lose sight of the larger issue of drug manufacturers being responsible for setting their own prices.

“I for one want to make darn sure this committee is not turned into the tool of the pharmaceutical industry” and only focuses on PBMs, Whitehouse said.